How To Use A Daily Planner To Organize Your Family Finances

Track the Amount of Money You Spend

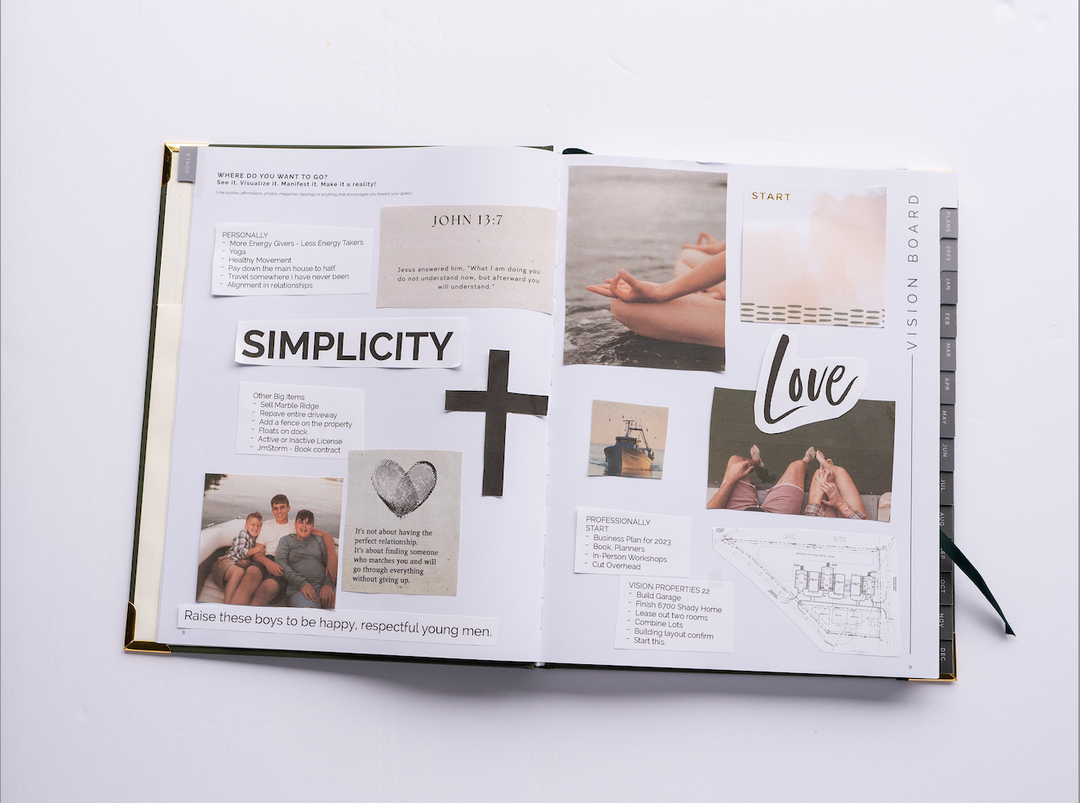

Our 2017 A5 Fancy Pants Daily Planner System is perfect to use for organizing your family's finances. It features a monthly budgeting section and an accountability partners page. The planner also helps you to create meal schedules, track health insurance co-pays, and track spending on entertainment.

Store Receipts in the Pockets of the Planner

Set Financial Goals

Plan for Retirement

You can maintain a healthy financial life by using a daily planner to organize your family finances. Each day, you should record how much money was spent on what to ensure nothing goes unaccounted for. If you don't track spending, you will wonder where the money went at the end of the month. A daily planner from STARTplanner also helps you stay focused on achieving your financial goals.

Leave a comment